Have a question? 720-328-2877 or Book a Call

Heirloom Wealth Management

An Independent Wealth Partner Built for High-Net-Worth Families

Heirloom Wealth was created for successful families who wanted more from their advisor than products, jargon, and performance that was hard to verify.

About Heirloom

Origin & Mission

After years inside large national firms, Heirloom’s founders saw how conflicted many advice models had become—where cross-selling targets, proprietary products, and platform restrictions often sat between clients and truly objective guidance. They left that world to build something different from the ground up: a firm where advice is transparent, incentives are simple, and every decision is made on the same side of the table as the client.

The name Heirloom reflects that purpose. To the team, an heirloom is “something of great value that you want to keep and protect” across generations. Managing a family’s wealth—and the future it funds—is treated with that same level of gravity and care.

Heirloom’s mission, in plain language, is to help people live well. That means giving high-net-worth clients the clarity, confidence, and peace of mind to enjoy the life they’ve worked for, while the firm organizes and manages the financial complexity behind the scenes. Clients are encouraged to go live their lives fully; Heirloom’s role is to ensure their plan and portfolio can support it.

If you are already working with a wealth manager—or looking for your first—Heirloom is built to answer the questions that often linger in the background:

“Am I truly getting objective advice?”

“How exactly have my investments performed?”

“Is anyone connecting my investments, taxes, estate plan, and cash flow into one coherent strategy?”

This page is designed to show you how Heirloom answers “yes” to all three.

A Coordinated Approach to Your Entire Financial Life

About Heirloom

Philosophy & Values

Built as a true wealth and tax partner

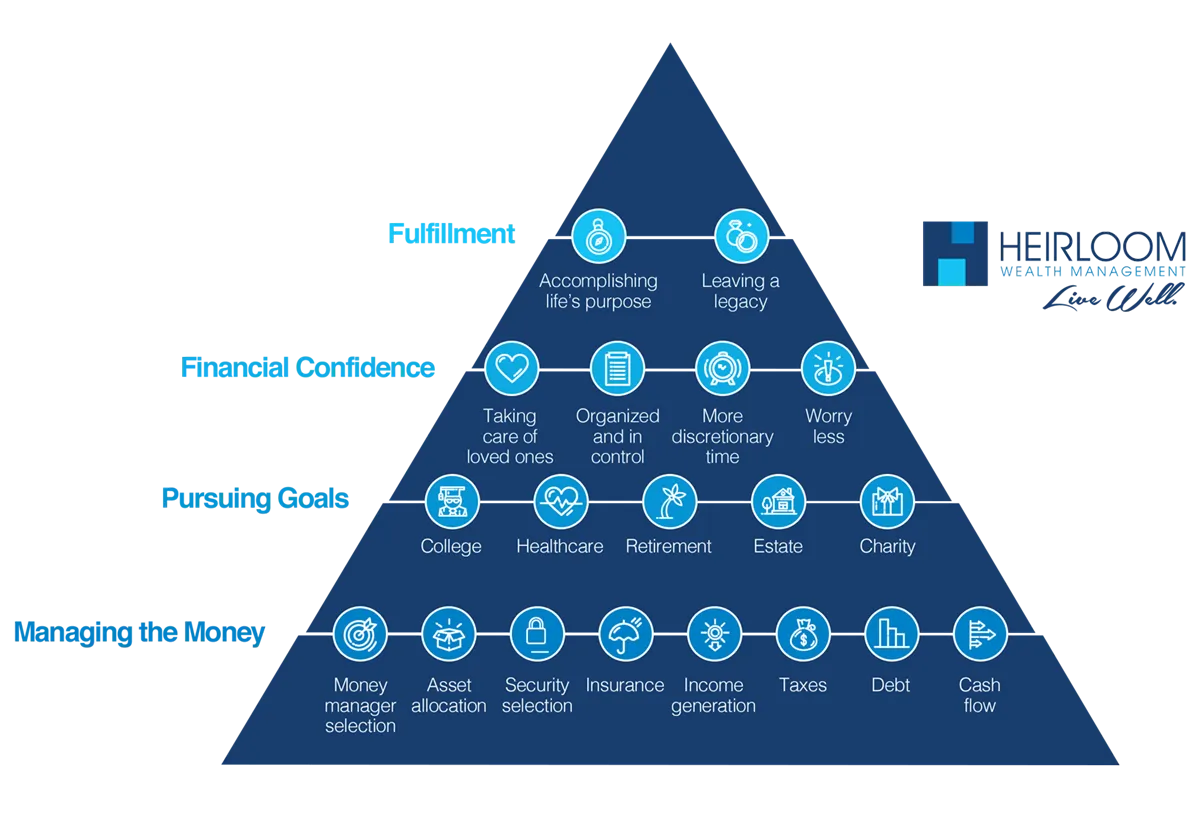

Heirloom defines wealth management as “everything your money touches”—investment management, tax planning, retirement income, estate and legacy planning, business and equity-comp issues, debt, cash flow, and more.

The firm combines:

Comprehensive wealth management – portfolio design, risk management, retirement income, and multi-generational planning.

Proactive tax strategy – in-house tax expertise and advanced planning that looks forward instead of simply reporting what already happened.

Bringing those disciplines under one roof allows Heirloom to make coordinated decisions instead of isolated ones—so investment, tax, and estate moves are designed to work together rather than at cross-purposes.

Fee-based fiduciary, aligned with client outcomes

Heirloom operates as a fee-based fiduciary. Clients pay an asset-based advisory fee, and Heirloom does not receive commissions for selling investment products. That structure is intended to keep incentives straightforward: when clients do well and stay on plan, the firm does well; if they do not see value and leave, the firm’s revenue decreases.

Key elements of this philosophy include:

Fiduciary standard – advice is given with a commitment to act in clients’ best interests and to avoid or disclose conflicts of interest.

Independence – as a federally registered investment adviser, Heirloom is not bound to a parent broker-dealer, proprietary platform, or product shelf. The team is free to consider a broad range of tools for each client’s situation.

Transparency – clients can see exactly how their accounts are performing and how much they are paying in fees at any time via Heirloom’s reporting systems.

Planning first, then portfolios

For Heirloom, investments are a means to an end—not the starting point. The relationship begins with a detailed, holistic financial plan that maps out cash flows, goals, and potential risks over the next several decades. That plan then drives each client’s investment policy, risk level, and tax strategy.

This planning-led approach is especially important for high-net-worth clients who:

Have multiple accounts at different institutions

Hold concentrated stock positions or private investments

Are balancing retirement, college, business, and legacy goals simultaneously

Need to understand what they can safely spend—and when

By anchoring everything to a plan, clients can evaluate their decisions against clearly defined objectives instead of reacting to headlines or short-term market moves.

Education, clarity, and confidence

Heirloom believes an educated client is a confident client. The firm invests heavily in client education—through regular meetings, clear reporting, and ongoing communication—so clients understand what they own, why they own it, and what to expect through different market environments.

The goal is not to turn clients into portfolio managers, but to:

Remove confusion and second-guessing

Set realistic expectations about risk and return

Help clients feel informed enough to make decisions comfortably

When markets become volatile, Heirloom’s clients generally already know how their portfolio is designed to behave—and what that means for their long-term plan.

Clients engage Heirloom Wealth to bring organization, coordination, and oversight to the many moving parts of their financial lives. We focuse on being a true partner, not just an investment manager, helping you make informed decisions across your balance sheet and over your lifetime.

Proof & Trust

Ten years of audited performance

Heirloom has built a 10-year audited performance history across multiple risk profiles—from conservative to more growth-oriented strategies—using actual live client accounts, not models or hypothetical backtests.

An independent third-party firm, The Spaulding Group, audits Heirloom’s composite returns, verifying:

The accounts included in each composite

The time-weighted returns over the full period

Changes in client objectives and risk profiles over time

That the data is complete, accurate, and not cherry-picked

This level of audited, risk-profile-specific performance reporting is still relatively uncommon in the advisory industry. It allows high-net-worth investors to compare Heirloom’s strategies against relevant benchmarks and peer groups using objective, independently reviewed data.

Important disclosure: Past performance does not guarantee future results. Investment returns and principal value will fluctuate, and investors may experience losses. Audited composites are presented for informational purposes only and may not reflect the experience of every individual client.

Transparent, client-level reporting

Beyond firm-level composites, Heirloom places a strong emphasis on client-level transparency. Through its reporting tools, clients can see:

Time-period performance (net of fees) for each account

Performance relative to benchmarks

Total advisory fees paid over any chosen period

This visibility stands in contrast to many large institutions where statements may show account balances and cash flows without clearly disclosing returns or benchmark comparisons. For investors considering a change from an existing advisor, Heirloom can also help interpret existing statements to clarify what their current results truly have been.

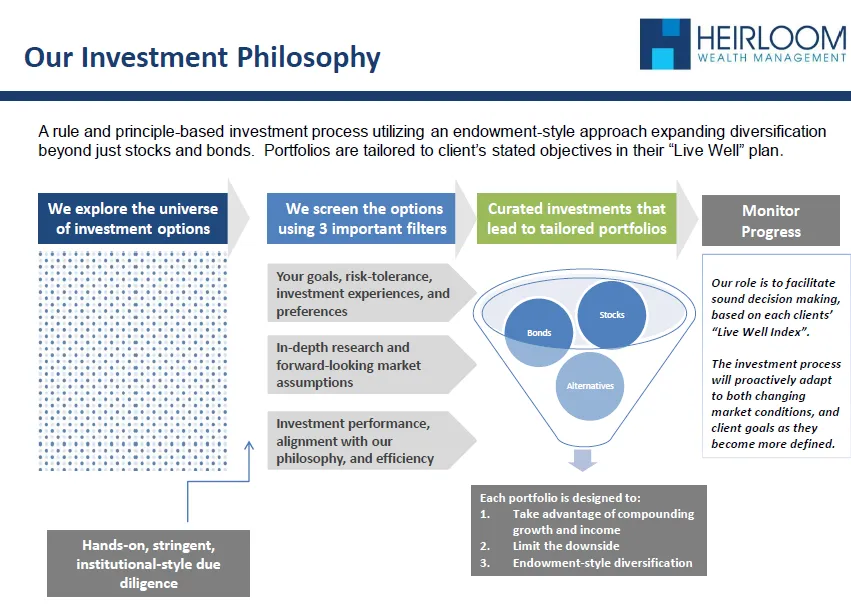

Risk-aware, institution-style diversification

Heirloom’s portfolios are built with the depth and breadth more commonly associated with endowments or family offices: diversified across stocks, bonds, and a thoughtful range of alternative asset classes.

In many reviews of new clients’ existing portfolios, the firm finds:

More risk than the client realizes

Concentration issues, particularly in employer stock or overlapping funds

Hidden or layered fees

Limited diversification that behaves like a single, undifferentiated bet

By contrast, Heirloom focuses on portfolios where:

Risk is aligned with the client’s plan and comfort level

Diversification is engineered to potentially reduce volatility meaningfully relative to traditional portfolios at similar return targets

Asset location (which accounts hold which investments) is coordinated with tax strategy over time

The objective is not simply higher returns, but better risk-adjusted outcomes that clients can realistically stay invested in through full market cycles.

A service model designed for long-term relationships

Trust is reinforced by how Heirloom structures its relationships:

Fit meeting first – the initial meeting is a two-way “fit” conversation to confirm needs, expectations, and values align on both sides before either party commits.

Comprehensive planning up front – new clients receive a full financial plan before major implementation decisions, creating a shared roadmap.

Structured review cadence – especially early on, clients typically meet multiple times per year to review progress, refine assumptions, and stay aligned.

High-touch communication – when markets move sharply or laws change, Heirloom proactively reaches out so clients are not left wondering what it means for them.

Over time, many clients report feeling a deep sense of relief—able to hand off day-to-day complexity to a team they trust while staying fully informed about the big picture.

Heirloom can provide a clear, objective view of where you stand and what might be possible.

Schedule A Strategy Session with Our Team

This initial conversation is designed to understand your goals, current situation, and priorities. You’ll have the opportunity to ask questions, explore how Heirloom’s integrated approach works, and determine whether a longer-term relationship makes sense—without pressure or obligation.

Our Services

A coordinated approach to managing investments, planning, and cash flow, designed to bring clarity and confidence to your financial life today and over time.

Tax strategies integrated with your broader wealth plan, helping inform decisions, improve efficiency, and support long-term outcomes through coordinated planning.

Contact

6400 S Fiddlers Green Circle

Suite 1970

Greenwood Village, CO 80111

3200 Cherry Creek S Dr.

Suite 130

Denver, CO 80209

© 2026 Heirloom Wealth. All Rights Reserved.

The information provided on this website is for general informational purposes only and is believed to be from reliable sources; however, its accuracy or completeness is not guaranteed. This material is not intended to provide tax, legal, or investment advice. Individuals should consult with qualified tax or legal professionals regarding their specific circumstances. Nothing contained herein should be construed as a solicitation or offer to buy or sell any security.

Heirloom Wealth Management LLC takes data privacy seriously. In accordance with applicable privacy laws, you may request information regarding the collection and use of personal data or exercise applicable privacy rights.

Investment advisory services are offered through Heirloom Wealth Management LLC, a Registered Investment Adviser.