Have a question? 720-328-2877 or Book a Call

HEIRLOOM WEALTH

Audited Performance You Can Trust

Objective, third-party–verified performance reporting designed to bring clarity, context, and confidence to investment decisions.

Objective Performance

Why Audited Performance Matters

Choosing a wealth manager is one of the biggest financial decisions most families ever make. It’s not just about what you own - it’s about whether your strategy is aligned to your goals, your risk tolerance, and the real-world results you’re receiving over time.

The Truth About Performance Metrics

Many investors believe they’re receiving clear performance reporting from their current provider - but in practice, a large number of firms show account growth, inflows/outflows, and charts without providing true percentage returns or an appropriate benchmark for comparison.

That creates a painful blind spot: even if your account value is increasing, you may not know whether the strategy is delivering value relative to the risks you’re taking - or relative to readily available alternatives.

Heirloom’s audited performance is designed to solve that problem with an objective standard: actual composite returns, verified by a third party, and benchmarked appropriately.

Performance Data Summary

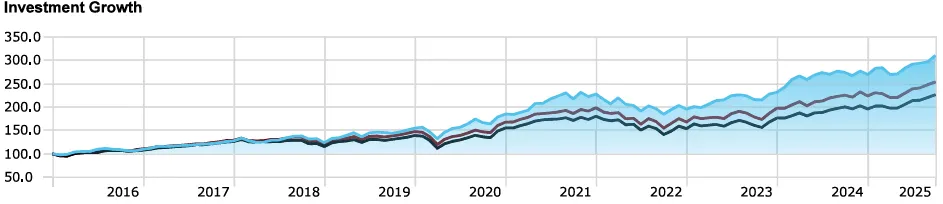

Heirloom maintains audited composites across multiple strategies ranging from more conservative allocations to more growth-oriented allocations, so results are relevant to different investor objectives - not a one-size-fits-all story.

Time period covered:

Heirloom’s audited track record is built from live client accounts, with data that - by the end of Q4 2025 - represents a decade of audited history (a milestone that remains uncommon in the advisory industry).

What the comparisons aim to show:

Heirloom’s reporting is designed to provide multiple frames of reference, including:

Blended index benchmarks aligned to the stock/bond mix of each strategy (for example: equity index exposure plus a bond index for the fixed income allocation).

Peer-category comparisons that evaluate how the strategy ranks against other solutions at similar risk levels.

Net-of-fee returns (what clients care about most)

Performance is presented net of fees, including investment expenses and advisory fees - so the numbers reflect what investors actually experience.

Methodology & Compliance

Independent verification

Heirloom engages a third-party performance auditing firm - The Spaulding Group - to audit composite performance and verify the integrity of reporting.

The audit process includes reviewing composite construction and account-level details to help ensure results aren’t selectively curated or “cleaned up” after the fact (for example, documenting when a client’s objective changes from conservative to growth and how that impacts inclusion).

Risk-adjusted focus (not just returns)

Performance isn’t just about upside capture. Heirloom evaluates results alongside downside risk management - because a strategy that can reduce the depth of declines may help investors stay committed to their plan through difficult markets.

One way this is explained is through the Sortino ratio, which emphasizes return relative to downside volatility (rather than treating upside and downside volatility the same).

Benchmarking and peer datasets

In addition to blended benchmarks, Heirloom uses Morningstar data to compare results to broad groups of mutual funds, ETFs, and other investment solutions in the same risk category.

Important disclosures

Audited performance should be evaluated in the context of an investor’s goals, time horizon, and risk tolerance.

Heirloom’s reporting is intended to be transparent and educational - not a guarantee of outcomes. Past performance does not guarantee future results.

Impact & Trust

Heirloom views audited performance as a practical expression of a broader commitment to transparency: clarifying what is knowable, what is measurable, and how investment decisions connect back to a family’s plan.

In plain English, the goal is to pursue a “great taste, less filling” outcome

Strong long-term compounding potential with disciplined downside risk management - aligned to each client’s specific risk profile.

This is particularly relevant for families coordinating multiple priorities - retirement readiness, tax strategy, estate planning, and education funding - where clarity and coordination matter as much as investment selection.

Finally, if you’re evaluating an advisor, one of the most practical screening questions is simple: can they provide accurate, time-weighted returns, benchmarked appropriately, and demonstrate value relative to alternatives?

FAQs

Q. What does “audited performance” actually mean at Heirloom Wealth?

Audited performance means Heirloom’s investment results are independently reviewed by a third party to verify accuracy and methodology. Rather than self-reported or marketing-based numbers, the performance data is validated to reflect real client outcomes using consistent standards across time and portfolios.

Q. Why did Heirloom choose to audit its performance when many firms don’t?

Heirloom chose audited performance to provide full transparency and accountability. Most advisory firms show account growth but do not report true percentage returns or benchmark comparisons. Auditing allows Heirloom to objectively measure results, compare them to appropriate benchmarks, and clearly demonstrate how portfolios have performed relative to alternatives.

Q. Is performance audited for all clients or just one strategy?

Heirloom audits multiple portfolio composites that reflect different risk profiles—from more conservative to more growth-oriented approaches. This allows prospective clients to review performance data that aligns with their specific risk tolerance rather than relying on a single firm-wide number.

Q. How does Heirloom benchmark its audited performance?

Performance is compared against blended benchmarks that match each portfolio’s stock and bond allocation, such as equity indexes and bond indexes. In addition, Heirloom compares results against peer investments, including mutual funds, ETFs, and other managed strategies, using third-party research tools like Morningstar to provide broader context.

Q. Does audited performance include fees and planning costs?

Yes. Heirloom’s audited performance is reported net of all fees, including investment expenses and advisory fees. This means the results reflect what clients actually experience, not hypothetical or gross returns that exclude the cost of comprehensive planning and ongoing advice.

If independently verified performance and full transparency matter to you, we invite you to schedule a conversation with our team. Let’s discuss how our approach may align with your goals.

Schedule A Strategy Session with Our Team

This initial conversation is designed to understand your goals, current situation, and priorities. You’ll have the opportunity to ask questions, explore how Heirloom’s integrated approach works, and determine whether a longer-term relationship makes sense—without pressure or obligation.

Our Services

A coordinated approach to managing investments, planning, and cash flow, designed to bring clarity and confidence to your financial life today and over time.

Tax strategies integrated with your broader wealth plan, helping inform decisions, improve efficiency, and support long-term outcomes through coordinated planning.

Contact

6400 S Fiddlers Green Circle

Suite 1970

Greenwood Village, CO 80111

3200 Cherry Creek S Dr.

Suite 130

Denver, CO 80209

© 2026 Heirloom Wealth. All Rights Reserved.

The information provided on this website is for general informational purposes only and is believed to be from reliable sources; however, its accuracy or completeness is not guaranteed. This material is not intended to provide tax, legal, or investment advice. Individuals should consult with qualified tax or legal professionals regarding their specific circumstances. Nothing contained herein should be construed as a solicitation or offer to buy or sell any security.

Heirloom Wealth Management LLC takes data privacy seriously. In accordance with applicable privacy laws, you may request information regarding the collection and use of personal data or exercise applicable privacy rights.

Investment advisory services are offered through Heirloom Wealth Management LLC, a Registered Investment Adviser.